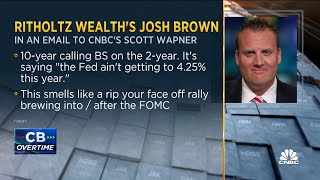

We could be lining up for a 'face-ripper' rally here, says Ritholtz's Josh Brown

We could be lining up for a 'face-ripper' rally here, says Ritholtz's Josh Brown

» Subscribe to CNBC TV: https://cnb.cx/SubscribeCNBCtelevision

» Subscribe to CNBC: https://cnb.cx/SubscribeCNBC

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

The News with Shepard Smith is CNBC’s daily news podcast providing deep, non-partisan coverage and perspective on the day’s most important stories. Available to listen by 8:30pm ET / 5:30pm PT daily beginning September 30: https://www.cnbc.com/2020/09/29/the-news-with-shepard-smith-podcast.html?__source=youtube%7Cshepsmith%7Cpodcast

Connect with CNBC News Online

Get the latest news: http://www.cnbc.com/

Follow CNBC on LinkedIn: https://cnb.cx/LinkedInCNBC

Follow CNBC News on Facebook: https://cnb.cx/LikeCNBC

Follow CNBC News on Twitter: https://cnb.cx/FollowCNBC

Follow CNBC News on Instagram: https://cnb.cx/InstagramCNBC

https://www.cnbc.com/select/best-credit-cards/

#CNBC

#CNBCTV

Oh he’s begging for the market to go higher now 😂😂😂😂

What about earnings Josh?

This is not the usual Josh Brown commentary. He was spot on for all of this year up until now. I think the recent Future Proof conference messed with his reality.

they will write the FED BLEFF in history !!! we will raise ; for how long can you?!? LOL

Is there a virtual freeze on accounts? Is this a “run on the banks” branded as a correction?

Hey Josh, Rip your face off rally??? To the downside LOL. Yields going higher is ahead fake. Josh, I hope you didn’t take on to much risk DON’T FIGHT THE FED!! Really bad report from FORD/Fed Ex. BIG HIKE TOMORROW. FOOD FOR THOUGHT EVERYONE: THE MARKET HAS NEVER I REPEAT NEVER BOTTOMED WHILE THE FED IS RAISING RATES!!! As of 245 pm 9/20 market down over 500 POINTS. MARKET IS PRICING IN .75 basis. If they surprise with 1.00 look out

Woommmm….Wrong ….This is how traps are set…and people fall into them….😂

VIX over 20!! Needs to unwind.

Brahahaha!!! Yea right. Still waiting

Speaker is right that Fed is already priced in, but the quarterly earnings reports is likely going to tank the market.

The Fed isn’t going to be aggressive during the election cycle…I could perhaps seeing them by surprising us w/ a larger rate hike than we’re expecting tomorrow….just maybe

Yeah it’s a face ripper if your long. I remember this guy saying Jeremey Grantham was off his rocker back in late 2021.

Sure good to know around 500 CEOs have left their companies after BLOWING $ 8 TRILLION ON BUYBACKS, into their pockets.

Retail lags market moves so therefore all retail now thinks they’re all Michael Burry short masters and have taken out shorts and puts that’s why the comments here are denying this fact. They’re all going to lose those gains in the next couple of days and then they’ll be back to their day jobs.

Great video sir, talking about gains and profits my one year success trade career with pro trading expert has been the most profitable I’ve had and he’s no doubt the best bitcoin trading platform handler or broker if I’m asked to say beginners can talk to him for help I also found out about him here on YouTube.

Surving recession inflation

Markets bouta rally up 👀

Any big rally, ‘face-ripping’ or not, will actually provide cover for the Fed to continue raising rates.

Its a good thing S&P Corps spent $ 8 TRILLION ON STOCK BUYBACKS in last 10 years so it helped the economy so much and they can survive a recession without laying off employees ! (sarc) RIGHT?

What a difference a day makes. This morning the 10 year has broken above the 3.5% level and is continuing the uptrend that started in early August. The strong labor market gives the Fed the backdrop to continue tightening. The core PCE has not peaked because people still have jobs and still have money to keep inflating prices. The Fed message should be focused on core PCE coming down over several months after which restrictive policy can shift back toward a neutral policy.

Short of biting a bats head off what’s the Maytag man got to say about the cost of borrowing money? ( like anyone wants to take a chance on a head biting fed. Chair to loan money to a private entity)

Face ripping or face melting. I’ll give Josh credit, he made a call based on conviction. Could’ve been Tom Lee with his March 2023 interest rate swap inflation call as gospel in order to justify a 40 market P/E.

No matter the stock market crash one needs to have different portfolio, I already invested in Forex and Crypto which are really profitable

Its a fools hope.

OH! SNAP. Was popular at the last top in rates?

When the planet becomes interest rate prognosticators ?

Yes this is really ass-ripper rally 🙁

No respect for Josh he is frontrunning all the time when recommending low-volume stocks live on air. they always pump immediately and he dumps. sec should look into this

This guy thinks he knows everything!! A 2-yr bond back at 2.99% and 10-yr back at 2.54%……Counting for a rally he must be desperate and probably over leveraged!!! Josh’s gonna be a B-A-G holder!

Allow me to translate………Please push the market up ( BUY OR COVER) so I can have a better short entry and then push the market lower with your stop loss so I can cover for a small profit. Global economy is broken, banks are increasing requirements, 2 year up, dollar up, stocks down no end in sight before mid 2023 and there is a greater chance that it gets much worse than much better. This guy is a duetchebag and a female orifice.

Ehhhh….

we could always pump a bit but we go down more midterm. The reason why we can pump any time a bit is, everybody is positioned short. see all comments here also. So some shorts may have to cover but after we go down even more

Maybe it is, and maybe it isn’t. Who knows?

Whackjobbery par excellence

Keep dreaming.

If there is any solace in Josh’s prediction, a lot more faces are getting ripped off right now than all the shorts might get if there is a reversal in today’s trend… 🙂

Scott and his "it’s 3900 on the S&P" narrative building, what a freaking joke. I guess Scott is one of those new age news guys where creating reality is more interesting than just reporting reality.

How is that prediction coming along?

🙏

We need a good face ripping rally. I’m ready to sell some more….then buy back in over time through early 2024…..when the REAL pain starts.

How did this video age overnight?

I wanted to trade cryptocurrency, but I got discouraged with the market price fluctuations and constant loss🥺

vix up, dollar up, yields up JB

These guys change their song everyday, maybe a pump so they can sell you their shares before the big slump! be careful people

always believe the opposite of what CNBC shows you.. it will be such a face palm situation for Mr Brown when the market tanks another 20%

For me , I’m currently viewing the current market as a giant opportunity for making generational wealth, thinking about invsting into stocks or digital-asset but how are we going to achieve all that given that the market has being a mess most of the year seems farfetched

Don’t care what limelight pundits like this guy says. Yeah maybe a short term up, but don’t be fooled, this economy stinks. The geopolitical situation stinks. The sociopolitical situation stinks. FedEx stinks. Baltic stinks. Housing stinks. Unemployment following. Earnings going down and multiple will be shrinking. No tech catalyst. Recession. Hello! Beauller! Beauller!

He thinks the 10 year is talking to him:)!!! He’s a hot dog. This market at best is choppy till 2024 unless republicans flip both. Then maybe marginal gains in averages. Policies have to change for any long term rally to happen.

They said foreign buyers and money laundering was a small percentage of the housing market. Somehow the FED is raising rates while China’s real estate market is in trouble, and Russia is at war and being sanctioned. Lets see what happens next. We all know the average person is struggling to afford housing.

How can you say demand is crashing, then say we could rally in the same sentence? You’re right, demand is crashing, and earnings will be poor, when earnings per share decreases, causing P/E ratios to become overvalued, then you will see major sell offs.

Mr John Darry’s bitcoin trading platform is the most profitable and most reliable I’ve ever invested in and my first two months of investing saw me record a huge increase in my wallet portfolio all thanks to this expert he’s the best of them all.

Grand ma Glases …. the new hipe …